Against a background of continued growth in construction activity last year, supply chain bottlenecks, unprecedented costs pressures, extraordinary weather conditions and looming economic recession, demand for heavy-side materials declined for the third consecutive quarter at the end of 2022 according to the Mineral Products Association (MPA).

Weakness in the market for heavy-side materials should be viewed as a red flag for the wider construction sector’s outlook, warns the MPA.

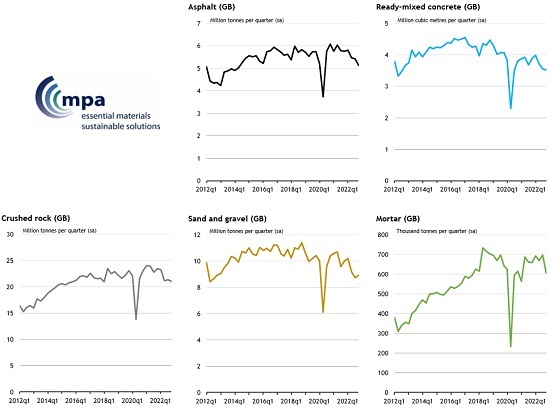

As the year closed, sales volumes of primary aggregates (crushed rock and sand & gravel) in Great Britain had fallen by 8.2% on an annual basis in 2022, asphalt fell by 6.5% and ready-mixed concrete by 3.8%, according to the latest quarterly survey by the MPA. Excluding the anomaly due to Covid in 2020, these are the fastest rates of decline recorded since 2012 for aggregates and asphalt and the second fastest rate of decline for ready-mixed concrete.

By contrast, demand for mortar, which is driven by housebuilding activity, is the only area of growth recorded in 2022, with sales volumes up 3.5% compared to 2021.

As a result, all markets monitored in the MPA survey either remained or fell back behind the sales volumes recorded before the pre-pandemic in 2019.

Mineral products are the essential heavy-side elements of the construction supply chain, forming the foundations and structures for roads, railways, housing, commercial and industrial developments, with MPA members supplying 90% of total market demand in Great Britain. In particular, the flow of these materials is critical in driving the early phases of construction work.

Signs of a slowdown in sales of aggregates, asphalt and concrete first emerged in June 2022, as the construction sector started to accrue vulnerabilities affecting costs and project viability, at a time of heightened economic uncertainty and lower consumer and business confidence.

The cost pressures have been particularly challenging for road projects, impacting the resilience of the asphalt market. At 21.8 million tonnes in 2022, asphalt sales in Great Britain were 4% below 2019 volumes and at their weakest since 2014 (excluding Covid-impacted 2020). Fixed budgets and significantly higher costs facing local authorities mean that fewer road improvement and maintenance projects can be delivered, and asphalt producers are reporting an increasing number of road projects being delayed, cut back or cancelled altogether. National Highways’ current 5-year road programme (RIS2) is also experiencing many delays and running well over budget, pushing up the risks to the deliverability and affordability of the overall programme.

The demand for ready-mixed concrete continues to be weighed down by sluggish activity in the commercial sector, particularly for new offices and retail tower projects. Growth in this sector has been driven by the refurbishment of existing office, retail and leisure space, which are less dependent on heavy-side materials. A 3.8% fall in ready-mixed concrete sales volumes in 2022 has knocked any hopes of recovery from the pandemic-related losses in 2020, with sales remaining 10% below 2019 volumes.

Aggregates sales have been supported by demand for fill materials, particularly in major infrastructure projects such as HS2 and Hinkley Point C, but are being held back by weaker demand for manufactured mineral products such as concrete and asphalt.

A 3.5% annual growth in mortar sales volumes after a 24% post-pandemic recovery in 2021 reflects the robustness in housebuilding activity in the past couple of years. However, a more significant slowdown is expected this year as tightening financial conditions put the brake on housing demand and new project starts.

Luke George, MPA Economist who compiles the survey, explained that the loss of momentum in mineral products markets in 2022 has contrasted with other more positive construction indicators. However, there are signs that an otherwise a solid pipeline of construction projects is increasingly being hindered by cost pressures and heightened economic uncertainty, and this is paving the way to a wider construction sector slowdown. Mineral products suppliers are early witnesses of this happening.

“Materials such as aggregates and ready-mixed concrete are ubiquitous to construction and typically used early in a project’s timeline. Less demand for these materials suggests that a slowdown in construction activity is already well underway, despite current construction output remaining elevated.”

Aurelie Delannoy, Director of Economic Affairs at MPA, added: “Industry forecasters now expect construction to endure a recession this year as a direct result of the challenging macroeconomic backdrop. For MPA members, this means another difficult year ahead, as they struggle to navigate an environment of rising costs and weaker demand simultaneously.”

“Over the next few weeks, Government has an opportunity to consider how it can support businesses, investment and growth as part of the forthcoming Spring Budget. Securing the continuity of the super-deduction on new plant and machinery in some form and reassessing plans to increase corporation tax from April 2023 would be welcomed first steps. There is also an urgent need for strenghtening Government’s infrastructure ambitions with improved delivery, where past records remain patchy. Local road maintenance is also an area where the Chancellor can help local economies and growth, but is currently being squeezed by inflation and other pressures.”