Demand for more capacity, lower operating costs and easier maintenance is driving development in the screening sector. Claire Symes reports

The rise in demand for high quality aggregates in Europe combined with the environmental and planning complexities of opening new quarries is starting to influence the design of new screens. Not only do quarry operators want screens that deliver accuracy, they also want equipment that can efficiently process material that would have once been considered uneconomic.

While the look of the latest screens is little different from previous generations, underneath innovative mechanisms and media are changing the way they work. Screening media panels are becoming more open to increase capacity, while the screens themselves are moving from inclined to vertical units with more aggressive action.

"Customers want higher capacity from the same sized units," said

"The difficulty with this type of material is that it is often dirtier than the top quality aggregates, making it more difficult to screen and it may also require washing before it is screened. The fines or clay in this fraction often results in clogging of the screens so more aggressive actions are being developed to ease processing." Increasing the amplitude and frequency of the vibrations delivered to the screen is also helping screen manufacturers to meet the demand for higher capacity. "Most quarry screens used to have inclined screen boxes but now there is a move towards horizontal screens," said Beattie. "Inclined screens use gravity but the aggregate spends less time on the screen bed compared to a horizontal one. The vibrating action is also different with a high amplitude on the horizontal units that allow them to process a higher tonnage of fine material.

"Closer control on gradation is essential these days as specifications in many countries around Europe are getter ever tighter. Customers want good cubicity from the crushing combined with accurate screening to give good management of the percentage of fines." Beattie has said that Terex is looking at the design of the bearings and shafts in its screens to meet these demands and will be launching new equipment this year featuring the latest refinements in these areas.

Capacity demand is also leading to technology more commonly associated with mining being introduced into the quarrying sector.

"We introduced the banana shape screening equipment that was designed for mining application into our TS line recently to boost quarry production," said Pradon. "The variable elliptical motion offers a higher capacity than is possible with current quarry style screens. Demand for the banana screens is not high as yet but we are expecting it to become stronger in the future."

Screen selection "There is no one size fits all when it comes to screens," said Pradon. "To get the right machine, we need to work closely with the quarry operator. Firstly we need to find out whether the site needs a fixed or mobile plant." The division between the choice of fixed or mobile is blurred because over the last five years, mobile machines have got bigger and are now able to compete with fixed plants in terms of capacity.

"The growth of the contract crushing and screening market has really driven both the growth of mobile screen sales and demand for larger machines," said

Planning permission issues in Europe for quarries mean that contract crushing will become a growth industry. Quarry operators are likely to become increasingly reluctant to invest in fixed plants for sites that may not have a long term future. Mobile plants offer operators the opportunity to move equipment easily and the use of contractors to manage the plant allows them to fix their costs more accurately.

"Five years ago, around 60% of screening units in the quarry market were fixed," said Beattie. "Today the split is 50/50 but over the next five years we expect mobile machines to gain a larger market share and reach around 55%." But the type of mobile machines is also changing. "Five years ago a high percentage of screen sales was made up of wheeled units but now most screens used in quarries are track mounted," said Nethery.

"The tracked units have better on site mobility and can be taken to the work site rather than hauling material to the screen. Dragging a wheeled unit offer a high risk of damage and if left in one place for a long period there is also potential for tyres to go flat or wheels to seize.

"Tracked units can also be more easily moved to clear up rock spillages that often occur during the screening process. This make housekeeping easier and usually makes work safer and leads to better performance." Environmental concerns have also influenced the design of screens in the last few years. Dust and noise are the main issues and this has led to many fixed plants being enclosed to reduce the impact.

"Dust suppression is something that is being addressed on mobile plants," said Beattie. "No specific legislation exists as yet but we expect it to be introduced in the next decade. We are focusing on systems that use a combination of water and chemical as a spray."

Maintenance matters Unlike many items of construction equipment, there is little or no market for second-hand screening equipment. "Screens for the quarrying market are more or less considered to be a wear part and there is little value in used equipment," said Pradon.

"The lifespan of a screen can be anything from five to 15 years depending on the conditions under which the screen is used." According to Pradon, although the tonnage and abrasiveness of the aggregate will influence the service life of the screen, the regularity of the maintenance has a bigger impact. "If the oil is not checked frequently and the liners replaced on time, it can significantly impact on the availability of the screen," he said.

This element of screens has really driven development that has made the machines easier to maintain, with improved access to service points and longer service intervals.

Beattie has also noticed a change in the service and maintenance field. "Five years ago, quarry operators had their own service technicians and carried out maintenance themselves," he said. "Now there is a much higher call for technical support and aftersales care."

Advances Addition of electronics to screening equipment has helped to simplify the operation with more automated processes but both Nethery and Beattie believe that there will be further developments in this area. "We have started to look at remote monitoring technology and expect to be offering screens with that capability before the end of the decade," said Beattie.

"Remote access to performance data will allow quarry operators to check on the actual production rate on site in real time and also to check machine information, such as operating hours, oil levels and wear rates," said Nethery. "This will allow them to make more informed decisions in planning maintenance to ensure maximum up time." According to Nethery, other developments in the next five years will focus of creating cost effective screens to both buy and operate. "More efficiency and higher throughput combined with lower investment and operating costs is the holy grail for the screening market," he said."

Media developments

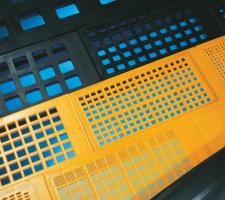

While screen box designs and styles have changed over the last few decades, so has the screening media. "In the 1960s the market was almost 100% wire mesh," said Metso Minerals screening media vice president Mats Dahlberg. "Now around half of the screening media market is accounted for by synthetic products." According to Dahlberg, synthetic media can offer between seven to 12 times more service life than wire mesh systems, which is the main attraction for quarry operators. But he said while the trend towards using synthetic media is likely to continue growing in Europe, the service life needs to be balanced with other performance issues.

"Enhanced rubber compounds could further improve the service life of synthetic products, reducing the need for maintenance and offering more up time," he explained. "They can also be designed to be self-cleaning but these benefits need to be put in context of the open area of the media, which is key to the production capacity of the screen. The main benefit of wire mesh is the greater open area but development is underway to improve the openness of synthetic media." As a wear part, media development is also starting to focus on recycling. "Wire meshes are simple to recycle as scrap metal," said Dahlberg. "But because synthetic products had a longer service life, little has been done to improve the environmental aspects of design. But that is changing. Polyurethane can be 100% recycled but the steel strengthening needs to be replaced by composite material to aid the recycling process."